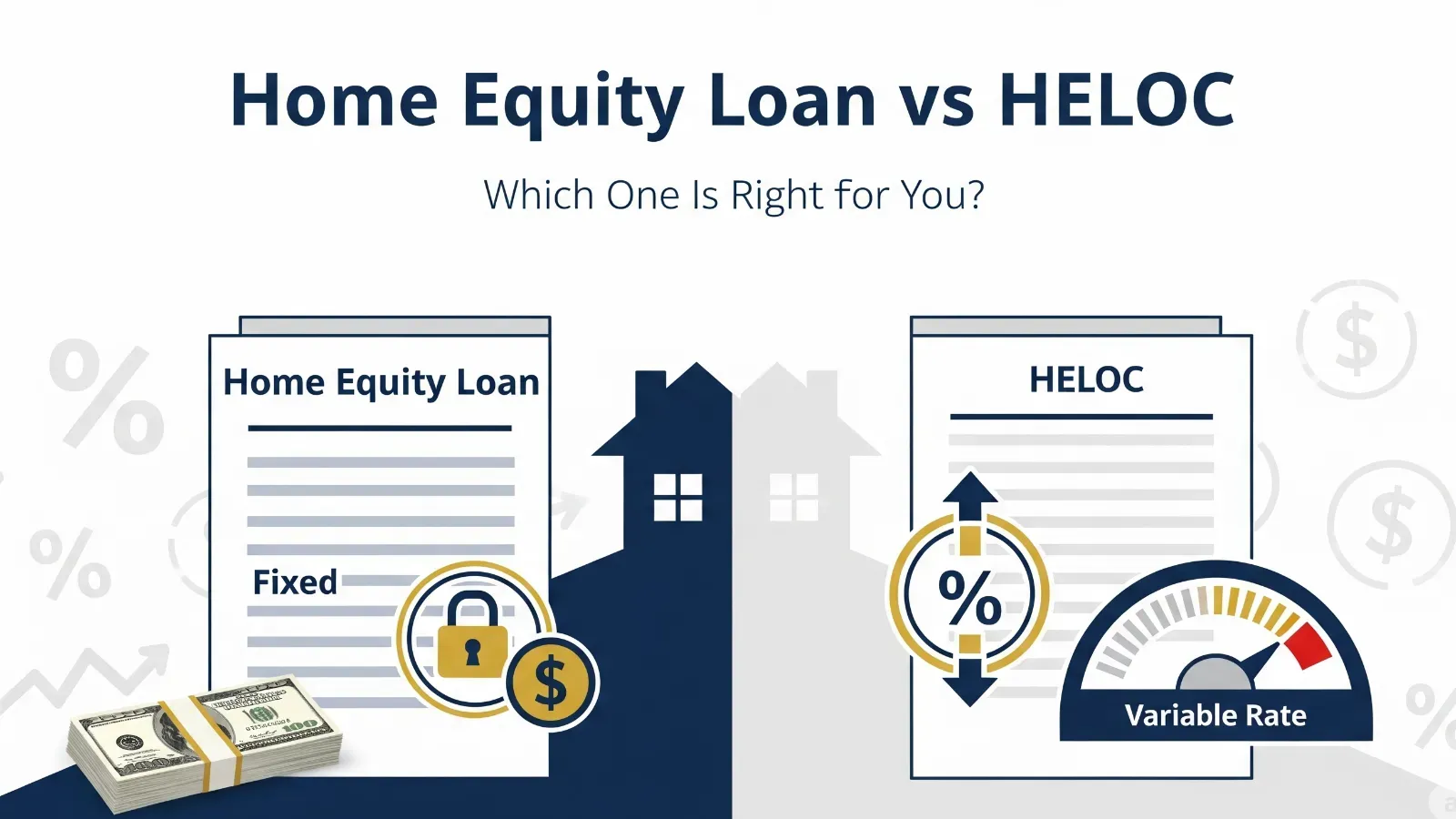

When it comes to borrowing money using their home equity, homeowners in the United States have two major options: home equity loans and home equity lines of credit, or HELOCs. Both are great ways to leverage your home value, but choosing between them depends on your financial goals and needs. If you’re wondering which one is better for you, this article will explain in-depth what a home equity loan and a HELOC are, their pros and cons, and which option might be right for you.

Understanding Home Equity Loans

A home equity loan is a loan that gives you a lump sum based on your home equity. Say your home is worth $400,000 and you’ve paid off $200,000 in debt, so you have $200,000 in equity. You can borrow a portion of this equity in the form of a home equity loan. The best part of this loan is that the interest rate is fixed, meaning you pay the same amount every month. The payment usually lasts from 5 to 30 years, making your planning easier.

Home equity loans are great for people who need a large sum of money at once, such as for home renovations, paying off old debt, or paying for children college fees. Because this loan uses your home as security, its interest rates are much lower than credit cards or personal loans.

- Advantages: Because of the fixed interest rate, your monthly payment is always the same, making it easier to budget. If you use this money for home improvements, you can also get a tax deduction on the interest. Also, interest rates are lower than other types of loans.

- Disadvantages: You have to take the entire amount at once, and if you need more money later, you will have to take a new loan. The biggest risk is that if you fail to make payments, your home could be seized.

What is a HELOC and how does it work?

A HELOC is a little different than a home equity loan. You can think of it like a credit card, where you get a certain credit limit, and you can withdraw as much money as you want. A HELOC has two parts: the first is the draw period, which usually lasts from 5 to 10 years. During this time, you can withdraw money when you need it and pay only the interest. The second part is the repayment period, which can be from 10 to 20 years, during which you have to repay the interest as well as the principal amount borrowed.

HELOC interest rates are mostly variable, meaning they can go up or down depending on the market. It is great for people who need small amounts of money frequently, such as for medical expenses, college fees, or a long-term project.

- Advantages: You only withdraw what you need, which keeps your interest costs low. You only pay interest during the draw period, so your initial payment is low. And if you pay off the money, you can borrow again.

- Disadvantages: Variable interest rates can increase your monthly payment, making it difficult to budget. Some HELOCs may also have annual fees or withdrawal charges.

What is the difference between a home equity loan and a HELOC?

There are several major differences between a home equity loan and a HELOC that may influence your decision.

- Method of payment: A home equity loan gives you the full amount at once, while a HELOC lets you withdraw up to your credit limit as needed.

- Interest rate: A home equity loan has a fixed interest rate, which keeps your payment stable. A HELOC has a variable interest rate that can change with Federal Reserve rates.

- Repayment structure: In a home equity loan, you pay both the principal and the interest upfront. In a HELOC, you only pay the interest first and the principal later.

- Uses: A home equity loan is good for large, one-time expenses, such as home renovation. A HELOC is better for expenses that are recurring or uncertain.

Which one is right for you?

To choose the right option between a home equity loan and a HELOC, you need to understand your needs and financial situation. If you need a large amount at once and want to make a single payment every month, a home equity loan is better for you. For example, if you are renovating your home and need $150,000, the fixed rate of a home equity loan will help you plan.

On the other hand, if you need flexibility and want to withdraw small amounts frequently, a HELOC is more beneficial. For example, if you plan to pay your child college fees every semester or have an unscheduled expense, a HELOC will only cost you as much interest as you use.

- Check your financial situation: Your credit score should be at least 680 for both, and your debt-to-income ratio should be less than 43%. You should also have at least 15-20% equity in your home.

- Market conditions: The average interest rate for a HELOC in 2025 is 8.26%, while a home equity loan is 8.91%. If interest rates go down, a HELOC may be cheaper.

My Final Notes

Both home equity loans and HELOCs are great ways to tap into your home’s equity, but the right choice depends on your needs. If you want stability and a large one-time withdrawal, choose a home equity loan. If you need flexibility and frequent withdrawals, a HELOC is for you. In both cases, take your credit situation, income, and risk appetite into consideration. Plan your payments in advance so you don’t risk losing your home. Get quotes from multiple lenders and talk to a tax advisor.

So, are you ready to get a home equity loan or a HELOC? Talk to a bank or online lender near you and choose the right path for you.